Design Your Life.

Live With No Limits.

Build Your Wealth.

Financial planning, dynamic investing, and business advisory for architects, engineers, and business owners ready to build lasting wealth and live life on their terms.

Start with the free 5-Pillars Assessment and see where you stand.

Architects & Engineers:

You built your firm. Now build your freedom.

Turn success into wealth

Eliminate financial uncertainty

Live with abundance

That’s what the No Limits Blueprint is all about.

Unlocking Freedom and Flexibility

The No Limits Blueprint unites your business and personal finances into one powerful system by driving growth, building wealth, and creating lasting freedom.

The No-Limits Blueprint. A structured approach to turning firm success into personal freedom.

We’ve helped architects and engineers at every stage of the journey: Stabilizing inconsistent cash flow, increasing profitability, reducing taxes, investing strategically, and preparing for retirement or an eventual exit.

The result? Greater clarity. More wealth. True freedom.

To choose what comes next

As Featured In

Comprehensive Financial And Business Solutions

True wealth is having the time to enjoy what matters most

Dynamic Investing Strategy

Our Dynamic Investing Strategy applies evidence-based positioning to changing market conditions, supporting growth while actively managing risk to support your lifestyle.

Core Principles of the Dynamic Investing Strategy

Protect First, Grow Second

Read the Environment

Stay Disciplined

Adjust the Risk Dial

A Different Path to Financial Abundance

Learn how we help firm owners like you turn a business that consumes your life into one that funds your freedom so you can live a life with NO LIMITS.

See how the No Limits Blueprint guides Firm owners from business success to a life of freedom and flexibility

After just five months, Angela, an architect, went from feeling like her goals were impossible to believing they were completely within reach.

John, a professional engineer, came in with a naturally risk-averse approach to saving and investing. After working together, he gained clarity and confidence in his financial picture, and felt empowered to balance long-term goals with present-day needs.

Financial strategy for long-term freedom

How it Works

5-Pillars Assessment

• Vision & Direction

• Wealth & Cash Flow

• Business Performance

• Scorecard & Blueprint

TIMELINE: 2–3 Months

12-Month Execution

• Regular Financial Reviews

• Strategic Planning

• Ongoing Guidance

• Special Projects

• Tracking Milestones

TIMELINE: 12 Months

Graduate or Recalibrate

Updated 3-Year Vision

New 12-Month Targets

TIMELINE: 1 Month

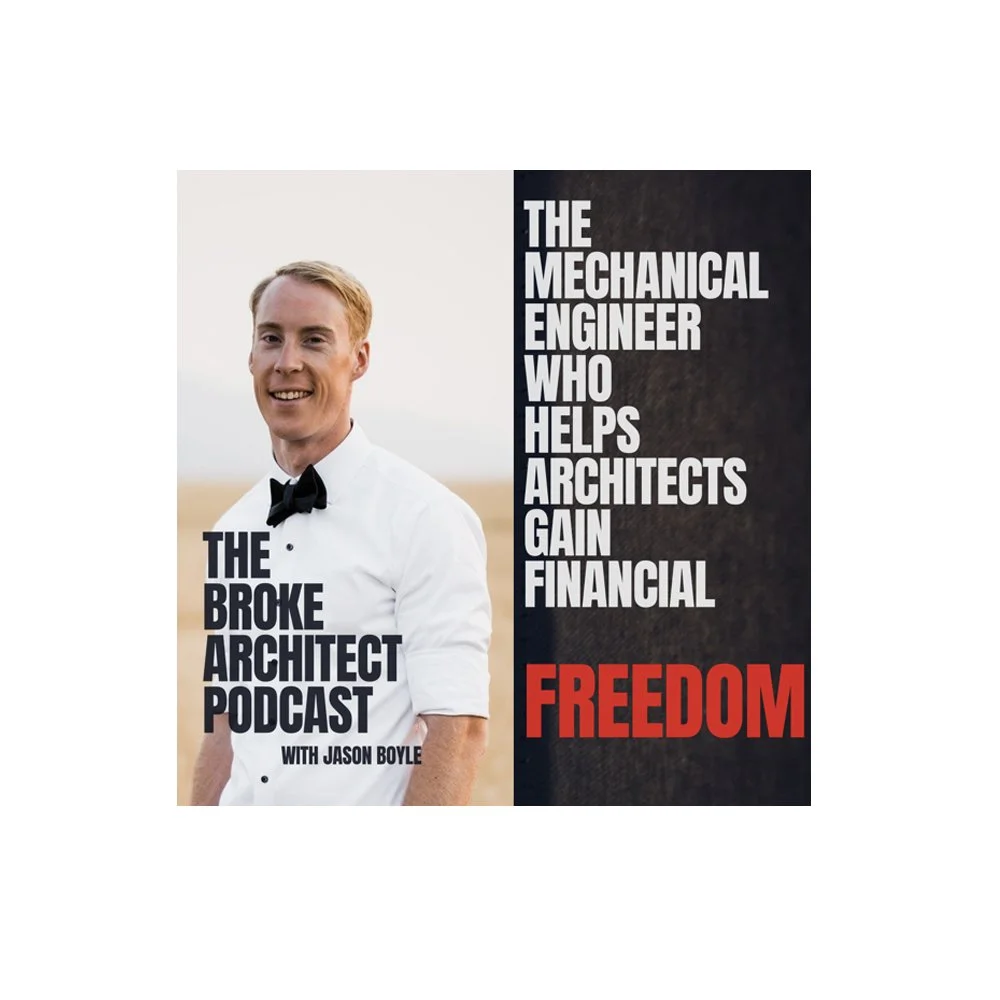

About Off the Beaten Path Financial

Before launching OBPF, Ryan built a seven-figure engineering department from the ground up, an experience that taught him how business growth, leadership, and financial clarity intersect.

Today, he brings that same engineering precision to financial and business planning, helping firm owners align their business success with the life they truly want to live.

Founded by Ryan Sullivan, PE, a former mechanical engineer turned financial and business planner, Off the Beaten Path Financial helps architects and engineers turn their firms into vehicles for personal freedom and lasting wealth.