20 Year Plan to Millionaire Status

Who doesn’t want to be a millionaire? Not only do you get the status from all those commas in your bank account, $1,000,000 invested in the stock market or real estate can typically produce around $50,000 in passive income. For someone without debt (or kids) that’s enough money to buy back at least some of the time you spend at your job right now.

Unless you already have it, $1,000,000 can feel like a daunting amount of money to get to though. In this post, I'm going to walk you through a simple (don’t confuse this to mean “easy”), 20-year plan to earn and work your way to that coveted double comma club.

For this example, we’re going to start off at a manageable place for someone in their mid to late twenties: making $65,000 with $0 invested. Now, if you’ve already read our article - Designing Your Life: 3 Skills to Master for Financial Freedom, you’ll know that the key to wealth is compounding interest. So the first thing you’re going to do is invest 10% of your income in the first year (that’s $6,500).

That $6,500 in the first year breaks down to about ~$540 per month (conveniently this is the 2023 IRA maximum contribution). If your current savings rate doesn’t line up with this, and you’re feeling daunted at the prospect of setting aside that much money in the first year, consider going through your last three months of spending to see how close you are to the recommended buckets and make adjustments accordingly:

Fixed Expenses/Bills (20-30%)

Debt (0-10%)

Saving (10-20%)

Investing (20-30%)

Variable Expenses/Spending (20-35%)

Don’t wait to start because you don’t think it is worth it. The sooner you start the longer you have the power of compounding working in your favor. The below example is simplistic but serves to illustrate the point. At a 7% annual return, contributing $6,500 for 10 years would be roughly equivalent to contributing $6,500 over 30 years if you started 10 years earlier.

Value of Starting Investing Early

Once you have your 10% of your income set aside for investing, the course forward is aggressive:

1) increase your income by 8% each year (that would be a $5,200/year increase the first year if starting with $65,000 in annual income)

2) increase your investing rate by 1% each year (10% -> 11% / $6,500 -> $7,720). Keep in mind that these percentages can average out over the full 20 years. You don’t need to increase your income 8% every year, it just needs to average out to that much over the full timeframe.

For anyone uncertain or feeling lost when it comes to negotiating and increasing your income, here are some possible avenues:

Ask for raises: if you don’t ask they certainly aren’t going to give it to you

Don’t be average: give them a reason to increase your pay

Change jobs: the most sure-fire way to get a raise

Have side-income: what do you spend your energy on outside of work? How can you monetize that?

Earn promotions: back to #2, and also keep in mind #1 (if you don’t ask for the promotion, they are less likely to give it to you)

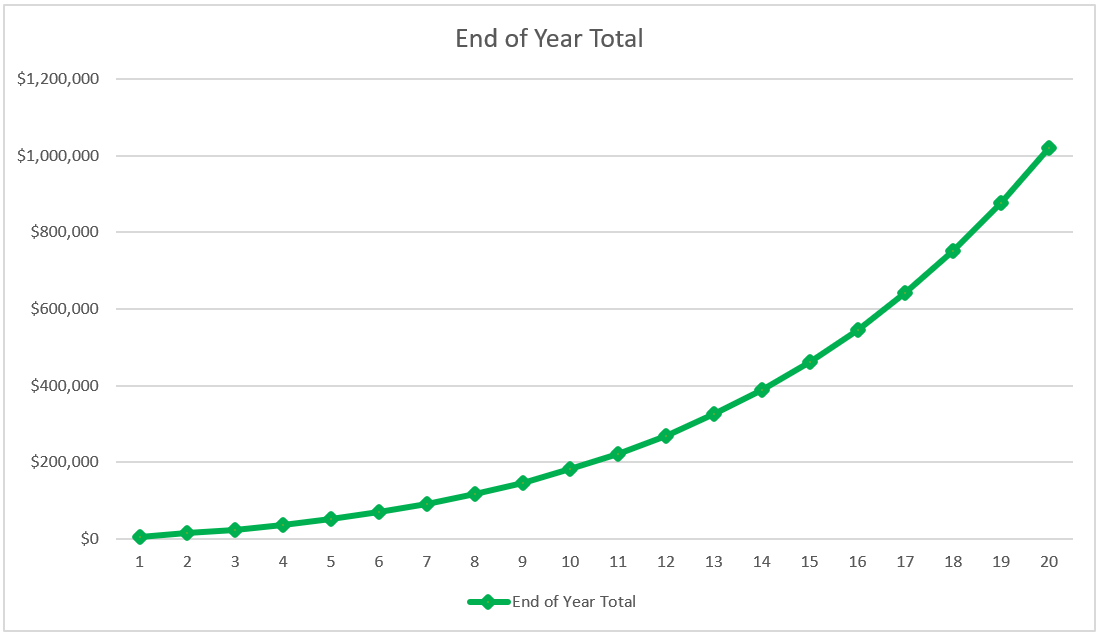

That’s the path. If you can follow those steps, remain consistent over that 20 year timeframe, and the market follows its historical averages, chances are you will achieve a net worth of $1,000,000.

Growth of Net Worth Over 20 Years

Depending on your current situation, (are you one of those people with kids we neatly avoided at the beginning of this post?) $1,000,000 might not be your financial freedom number. If you have bigger fish to fry, head over to our post Designing Your Life: 3 Skills to Master Financial Freedom to learn more about goal setting and finding your own path, or consider scheduling a free discovery meeting to get a personalized Financial Path created just for you.